Rebuilding after a Tornado

The Role of Homeowners Insurance in Recovery

Publication Date: 2022

Abstract

Insurance against disaster plays a critical role in community resilience by providing policyholders with reliable and timely payments for repairing or reconstructing damaged houses. By allowing homeowners to transfer risk and avoid excessive financial burdens, insurance (this study specifically looked at homeowners insurance) can encourage homeowners to repair or reconstruct damaged houses without experiencing significant financial hardship. Insurance can also reduce financing delays in the housing recovery process. While the role of insurance can be supported and understood based on quantitative data, the influence of homeowners insurance on recovery—specifically in tornado-impacted communities—is under-studied. This research study focuses on understanding whether sufficiently insured houses can have a positive impact on the resilience of tornado-impacted communities. The research team conducted two sets of online surveys of residents in five communities in Missouri, Ohio, and Kansas whose houses were damaged by the May 2019 tornados. Based on the survey data, this study quantitatively assessed the effects of homeowners insurance status and coverage on post-tornado repairs, financial hardships, and housing recovery delays. Survey results indicated that sufficient insurance coverage helped homeowners avoid post-tornado financial devastation and repair their damaged houses in a timely manner.

Introduction

Tornados are one of the most violent and costliest natural hazards in the United States, accounting for 40 percent of insured catastrophe losses between 1997 and 2016 (Insurance Information Institute, 20211). Many strong tornados in recent years (such as in Tuscaloosa, Alabama, and Joplin, Missouri, in 2011; Moore and El Reno, Oklahoma, in 2013; and Nashville, Tennessee, in 2020) resulted in billions of dollars in direct and indirect economic losses. On average, about 1,000 tornados strike the United States every year (Insurance Information Institute, 2021). While federal, state, and local governments work to reduce tornado risk for communities, individual responsibility also plays a significant role in reducing risk and expediting housing recovery.

Individual homeowners can take various actions to reduce tornado risks by applying structural mitigation measures and purchasing insurance. Mitigation measures cannot reduce the probability of tornado occurring but can limit consequences, such as housing damage and human and economic losses). On the other hand, insurance does not reduce tornado risk but rather transfers risk to another party (i.e., from homeowners to insurance company) through an insurance policy. It reduces excessive financial burdens of homeowners following a tornado and expedites the repairs of tornado-impacted buildings and the recovery of the community where they are located (Zhao et al., 20202). As such, these actions play different roles in community resilience. The effects of mitigation measures on tornado-induced property damage and community resilience can be easily quantified through tornado catastrophe modeling and simulation if sufficient data about tornadic wind and its effects on house damage and losses are available (Amini and van de Lindt, 20143; Elsner et al., 20134; Eppelbaum, 20135; Masoomi and van de Lindt, 20166; Plaz, 20187; Refan et al., 20208; Roueche et al., 20179). However, the quantitative assessment of insurance effect on community resilience has been less studied, especially in tornado-impacted communities (Lee and Li, 202110; Zhao et al., 2020).

Two types of insurance (homeowners insurance and flood insurance) can cover tornado-related damage to homes and belongings. Most standard homeowners insurance policies include dwelling and personal property coverage, which can help homeowners repair, rebuild, or replace homes and belongings damaged by tornadic winds. If a tornado is accompanied by heavy rain, damage caused by flooding will often not be covered by homeowners insurance unless the rainwater enters through a tornado-damaged roof or wall. Therefore, it is wise for homeowners to purchase separate flood insurance to cover their homes and belongings in the event of floods.

While most lenders require homeowners to insure their property, many homes are underinsured or uninsured. According to the CoreLogic Residential Cost Handbook (2021)11, approximately four million homes in the United States (3% of the total number of housing units) are uninsured and about 64% of American homes are underinsured by an average of 27 percent of their home’s replacement value.

Flood insurance is not federally required for homes outside of high-risk flood areas and only 50% of American homes in National Flood Insurance Program (NFIP) flood zones have flood insurance. This is much less than the number of houses with homeowners insurance, and its uptake rate becomes far less outside the NFIP flood zones (Altmaier et al., 201712). Lack of insurance and underinsurance issues can cause financial hardship for homeowners and leave them unable to repair or rebuild their homes, prolonging the housing and community recovery process. Recently, several studies (Lee et al., 202213; Lin and Wang 201714; Miles and Chang, 200715) have considered the effect of insurance on the housing recovery process, modeling the reduced recovery time (the sum of delay time and the time it takes to repair and/or rebuild) of damaged houses made possible by reliable and timely insurance payments. However, many examine the role of insurance in earthquake-impacted community and only consider binary variables (insured or not) in their insurance demand models. Binary variables of insured states are reasonable in earthquake-impacted communities because purchasing earthquake insurance is voluntary and the insured states can serve as a major criterion to determine the recovery speed of damaged homes. In tornado-impacted communities, however, standard homeowners insurance might cover the damage caused to many homes, so coverage limits play a more significant role in the housing recovery process than insured states do. Moreover, while insurance affects both the housing recovery process and homeowner financial stability, most of the existing studies ignore its effects on the post-tornado financial devastation homeowners might experience. This study examines the role of insurance in tornado-impacted communities by surveying residents in Missouri, Ohio, and Kansas whose houses were damaged by the May 2019 tornados.

Methods

Research Design

This study was designed to answer the following research question: Will sufficiently insured houses have a positive impact on community resilience? More specifically, we tested if sufficiently insured houses could encourage more homeowners to repair or rebuild their damaged homes, reduce their post-tornado financial hardship, and reduce the delays in the housing recovery process.

To answer that question, this study conducted two sets of online surveys of residents whose properties were damaged by the May 2019 tornados to collect quantitative and qualitative data. Then, a series of hypothesis tests were performed to determine if homeowners insurance would have any statistically significant effect on the housing recovery process and the financial hardship of individual homeowners after tornados.

Participants and Sampling

This study recruited residents in five communities that were severely affected by the May 2019 Tornado Outbreak—a series of destructive tornados that impacted a wide swath of the United States from May 17 to May 30, 2019. The study site includes Jefferson City, Missouri (EF-3 tornado), Douglas and Leavenworth, Kansas (EF-4 tornado), and Dayton and Trotwood, Ohio (EF-4 tornado). The May 2019 tornados resulted in a total of $190 million in insured losses in Missouri (Missouri Department of Commerce & Insurance, 202016) and the largest insured losses in state history in Ohio. Official data about insured losses in Kansas were not available.

Qualtrics professional panels recruited participants for two sets of online surveys in May 2020 and February 2021, respectively. The inclusion criteria for participating in the survey was residents living in the study site who were at least 18 years of age and whose houses sustained at least minor damage from the May 2019 tornados. Of approximately 1,000 houses damaged due to the May 2019 Tornado Outbreak in the study site, a total of 133 participants (including 86 responses in the first survey and 47 responses in the second survey) responded to the survey, but 33 were considered invalid because they did not meet the following criteria: (a) the mortgage must be less than or equal to the property value; (b) the dwelling coverage limit must be less than or equal to the property value; and (c) the insurance premium and deductible must be within a reasonable range given the dwelling and content coverage limits. In the final sample of 100 participants, 60% of the respondents were female, and 40% of the respondents were male. At the time of the tornados, the majority of the respondents (75%) had homeowners insurance, while only 29% of the total respondents had flood insurance.

Procedure

Participants were required to have the homeowners insurance policies they held in May 2019 on hand so that they could answer questions related to the documents. The first online survey consisted of closed-ended qualitative and quantitative questions about:

- Demographic information

- Property type

- Major construction material of the home

- Property and personal belonging values

- Mortgage/Rental Status

- Structural damage and economic loss caused by the May 2019 tornados

- Pre- and post-tornado financial stability

- Homeowners insurance coverage, deductibles, and premiums

- Time to receive insurance payment and government disaster assistance, if applicable

- Repair decisions

- Home recovery duration

In addition to the information used to quantitatively assess the effect of homeowners insurance policy on the housing recovery process, the second online survey included a series of open-ended questions about respondent experiences during the insurance claim process and building repair/reconstruction process.

Data Analysis

The research team quantitatively assessed the effect of homeowners insurance coverage on repair decisions, post-tornado financial hardship, and the delay time of the housing recovery process. The effect of flood insurance was not assessed in the final report given that homeowners insurance covered most tornado-induced structural damage and the associated flooding damage. To test if sufficiently insured houses have a positive impact on community resilience, the homeowners who provided the valid responses were divided into three groups—uninsured homeowners, underinsured homeowners, and fully insured homeowners.

A two proportion Z-test was used to evaluate the significance of the differences in proportions across the groups. For example, the proportion of uninsured homeowners who experienced post-tornado financial hardship was compared to the proportion of fully insured homeowners experiencing post-tornado financial hardship in order to assess the effect of insurance (especially full coverage insurance) on financial stability. Similar tests were performed for different combinations among the three groups, as well as for housing repair decisions. The effect of homeowners insurance coverage on the delay time of the housing recovery process was assessed using Kruskal-Wallis H tests. The Kruskal-Wallis H test was selected because it is a non-parametric test that relaxes the assumption for Analysis of Variance, which is the assumption of normality.

Results

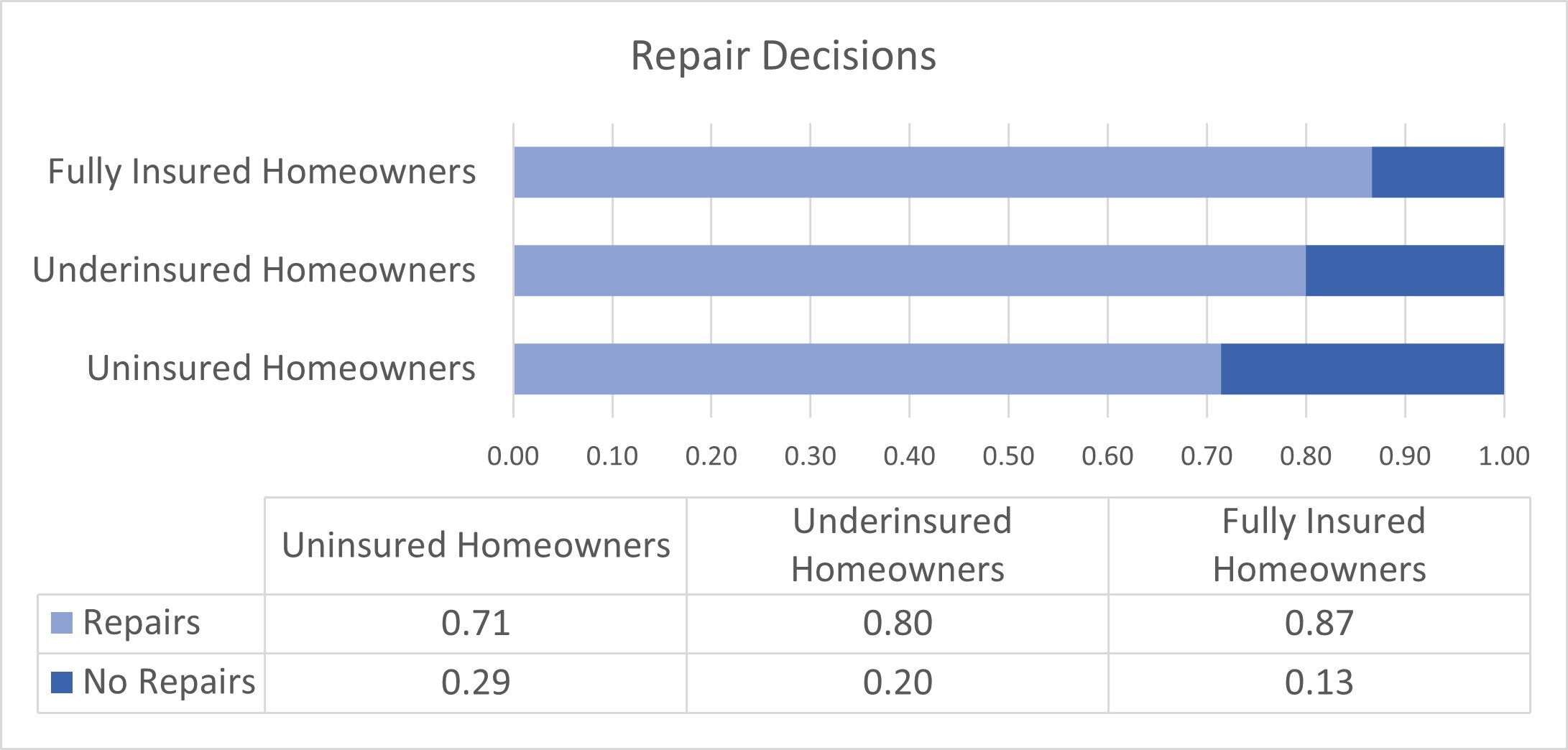

Effect of Homeowners Insurance on Repair Decisions

The repair decisions of the three respondent groups are compared in Figure 1. As expected, uninsured homeowners were the least likely to repair their damaged homes, mainly due to lack of funds, while higher levels of insurance coverage encouraged more homeowners to repair homes. However, the two proportion Z-test of the sample data showed that, at the 5% level of significance, there was not sufficient evidence to conclude that the proportion of uninsured homeowners who repaired their houses was significantly less than the proportion of underinsured or fully insured homeowners who did the same. This might be explained by the fact that, after dividing the collected valid responses into three groups, the sample size of each group became too small to detect a significant statistical difference between the proportions.

Figure 1. Comparison of Repair Decisions

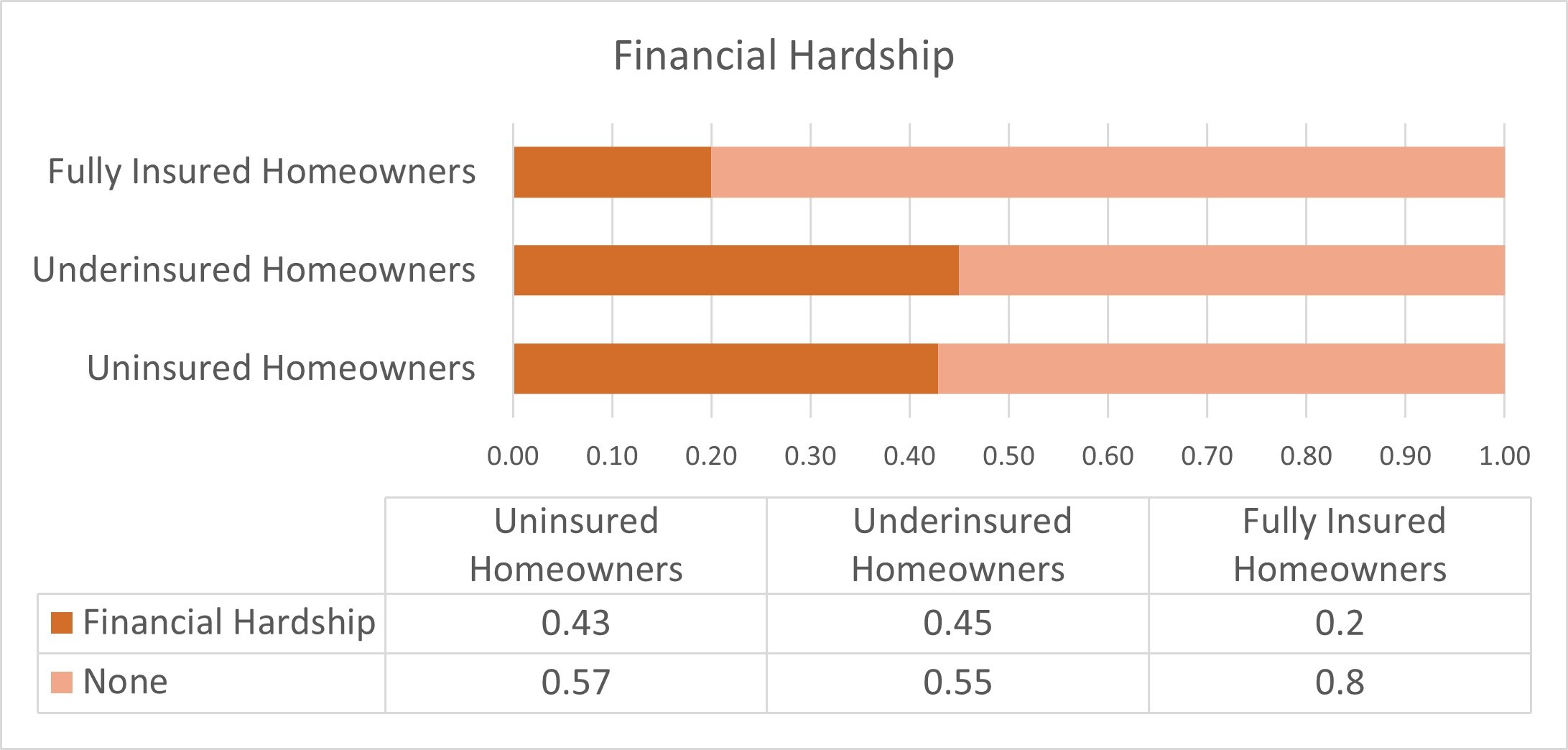

Effect of Homeowners Insurance on Financial Hardship

The effect of homeowners insurance coverage on post-tornado financial stability was assessed by asking about financial hardships respondents experienced due to tornado damage, including falling into mortgage default or forbearance, being forced to sell properties, or incurring large amounts of debt. As shown in Figure 2 below, the majority of fully insured homeowners (80%) indicated that they did not experience financial hardship after the May 2019 tornados because most of the house repair or reconstruction costs were covered by insurance claim payments.

Figure 2. Comparison of Financial Hardship

The financial disruption that can result from being under insured or not having insurance is also summarized in Figure 2. Underinsured homeowners were more likely to experience post-tornado financial hardship compared to their uninsured counterparts because a higher portion of uninsured homeowners did not repair their damaged homes and sold their properties. Similar to the repair decisions, however, differences in the proportions of homeowners who experienced financial hardship were not statistically supported by two proportion Z-tests because of small sample sizes. While increasing sample size could potentially resolve this issue in future research, a large sample size can be difficult to achieve because tornado touchdowns are geographically small and limit the number of houses damaged.

Effect of Homeowners Insurance on Delay Time

The survey question asked participants about the period of time between the date when their houses were damaged by the May 2019 tornados and the initiation of repair or reconstruction. Delay time could have been caused by a variety of factors, including post-tornado inspection; engineering mobilization and review or redesign; financing; contractor mobilization and bid process; and permitting (Almufti and Willford, 201317; Zhao et al., 2020).

By assuming that all the aforementioned factors except financing had the same statistical properties (e.g., mean and standard deviation) for the three groups, the differences in wait times between the groups could be explained solely by financing delay. The mean wait times were 194 days, 144 days, and 113 days for uninsured, underinsured, and fully insured homeowners, respectively. This was consistent with our expectation that homeowners with sufficient insurance coverage might receive timely claim payment from insurance companies that could cover most of the repair cost and ultimately speed up the housing recovery processes. A set of Kruskal-Wallis H tests were also performed to determine if there were statistically significant differences between the three groups on delay times. Table 1 summarizes the test results for various combinations. At the 10% level of significance, there was a significant difference between uninsured and fully insured homeowners. Similarly, the p-value (0.0927) indicated that, at the 10% level of significance, the median wait times for uninsured homeowners were different from under and fully insured homeowners.

Table 1. Comparison of Wait Times Among Resident Groups

| Comparison | Null hypothesis | Alternate hypothesis | p-value |

|---|---|---|---|

| Uninsured vs. Underinsured | mA = mB | mA ≠ mB | 0.2339 |

| Uninsured vs. Fully Insured | mA = mC | mA ≠ mC | 0.0698 |

| Underinsured vs. Fully Insured | mB = mC | mB ≠ mC | 0.3914 |

| Uninsured vs. Insured | mA = mB+C | mA ≠ mB+C | 0.0927 |

Conclusions

Key Findings and Limitations

This research examined the effect of homeowners insurance on post-tornado repair decisions, financial hardship, and the delays in the housing recovery process in tornado-impacted communities. The descriptive survey results suggested that sufficient homeowners insurance coverage (a) encouraged homeowners to repair their damaged homes; (b) helped homeowners avoid post-tornado financial disruption; and (c) reduced delay time associated with financing by providing expedited insurance claim payment that could speed up the housing recovery process. However, some of these results were not statistically significant (using two proportion Z-tests and Kruskal-Wallis H tests). It is possible that the small sample size was a factor in the lack of significant results. Although this study only collected the data associated with the May 2019 tornados, more data from residents whose houses were damaged by other tornados should be collected to increase sample size and further examine the hypothesis that sufficient insurance coverage will enhance the resilience of a tornado-impacted community.

Future Research Directions for the Project Team

Future studies will consider the combined effect of homeowners insurance and flood insurance on post-tornado repair decision, financial hardship, and the delay time of the housing recovery process, and will develop quantitative models that explain the relationship between independent variables (i.e., insurance coverage) and the three dependent variables. The models will include logistic regression and linear/non-linear regression. These quantitative models will be used in the recovery simulation of Dayton and Trotwood, Ohio, following the May 2019 tornados to compare the simulated community recovery with the actual recovery for the purpose of validation and to further examine the role of insurance on community resilience.

References

-

Insurance Information Institute (2021, September). Facts + Statistics: Tornadoes and thunderstorms. https://www.iii.org/fact-statistic/facts-statistics-tornadoes-and-thunderstorms ↩

-

Zhao, J., Lee, J. Y., Li, Y., & Yin, Y. J. (2020). Effect of catastrophe insurance on disaster-impacted community: Quantitative framework and case studies. International Journal of Disaster Risk Reduction, 43, 101387. ↩

-

Amini, M. O., & van de Lindt, J. W. (2014). Quantitative insight into rational tornado design wind speeds for residential wood-frame structures using fragility approach. Journal of Structural Engineering, 140(7), 04014033. ↩

-

Elsner, J. B., Murnane, R. J., Jagger, T. H., & Widen, H. M. (2013). A spatial point process model for violent tornado occurrence in the US Great Plains. Mathematical Geosciences, 45(6), 667-679. ↩

-

Eppelbaum, L. V. (2013). Non-stochastic long-term prediction model for US tornado level. Natural Hazards, 69(3), 2269-2278. ↩

-

Masoomi, H., & van de Lindt, J. W. (2016). Tornado fragility and risk assessment of an archetype masonry school building. Engineering Structures, 128, 26-43. ↩

-

Plaz, F. S. (2018). Tornado and Hurricane Hazards: Reconnaissance, Structural Analysis and Vulnerability Modeling (Doctoral dissertation). ↩

-

- Refan, M., Romanic, D., Parvu, D., & Michel, G. (2020). Tornado loss model of Oklahoma and Kansas, United States, based on the historical tornado data and Monte Carlo simulation. International journal of disaster risk reduction, 43, 101369.

-

Roueche, D. B., Lombardo, F. T., & Prevatt, D. O. (2017). Empirical approach to evaluating the tornado fragility of residential structures. Journal of Structural Engineering, 143(9), 04017123. ↩

-

Lee, J. Y., & Li, Y. (2021). A First Step Towards Longitudinal Study on Homeowners’ Proactive Actions for Managing Wildfire Risks. Natural Hazards Center Quick Response Grant Report Series, 328. Boulder, CO: Natural Hazards Center, University of Colorado Boulder. Available at: https://hazards.colorado.edu/quick-response-report/a-first-step-towards-longitudinal-study-on-homeowners-proactive-actions-for-managing-wildfire-risks ↩

-

CoreLogic. (2021, September). Residential cost handbook. https://www.corelogic.com/ ↩

-

Altmaier, D., Case, A., Chaney, M., Dolese, N., Donelon, J.J., et al. (2017). Flood risk and insurance. National Association of Insurance Commissioners & The Center for Insurance Policy and Research. ↩

-

Lee, J.Y., Ma, F., & Li, Y. (2022). Understanding homeowner proactive actions for managing wildfire risks. Natural Hazards. https://doi.org/10.1007/s11069-022-05436-2 ↩

-

Lin, P., & Wang, N. (2017). Stochastic post-disaster functionality recovery of community building portfolios II: Application. Structural Safety, 69, 106-117. ↩

-

Miles, S. B., & Chang, S. E. L. (2007). A simulation model of urban disaster recovery and resilience: Implementation for the 1994 Northridge earthquake (No. 14). Buffalo, NY: Multidisciplinary Center for Earthquake Engineering Research. ↩

-

Missouri Department of Commerce & Insurance. (2020). Insured losses following May 2019 tornadoes in Missouri reached nearly $190 million. Available at: https://dci.mo.gov/news/newsitem/uuid/f1e6b1a0-a587-460a-bea4-76fbf0fcef75 ↩

-

Almufti, I., & Willford, M. (2013). REDiTM rating system: Resilience-based earthquake design initiative for the next generation of buildings. Arup Co. ↩

Lee, J & Yan, G. (2022). Rebuilding after a Tornado: The Role of Homeowners Insurance in Recovery (Natural Hazards Center Mitigation Matters Research Report Series, Report 11). Natural Hazards Center, University of Colorado Boulder. https://hazards.colorado.edu/mitigation-matters-report/rebuilding-after-a-tornado