A powerful, 7.8-magnitude earthquake struck the coast of Ecuador on April 16, 2016, killing more than 650 people and causing widespread destruction. © European Union/ECHO/J.Lance 2016

POST-EARTHQUAKE FINANCIAL decision-making is a realm beyond that of many people. In the immediate aftermath of a damaging earthquake, billions of dollars of relief, recovery, and insurance funds are in the balance through new financial instruments that allow those with resources to hedge against disasters and those at risk to limit their earthquake losses and receive funds for response and recovery.

Many of these mechanisms, such as catastrophe bonds (also called CAT bonds), have come to rely on near-real-time (NRT; typically minutes to a few hours) earthquake information that allows those affected by the consequences of a disaster to quickly access financial capital.

NRT products had been routinely used for situational awareness, to support response and facilitate aid, but the evolution of these innovative post-earthquake financial decision-making tools is expanding the usage of NRT information. This is obviously important for those who generate NRT earthquake alerts and it should also be of interest to those in the earthquake hazard and risk community. Such financial strategies can have significant benefit for stakeholders: They facilitate risk transfer, foster sensible management of risk portfolios, and assist in disaster response and recovery. Making funds available for at-risk populations also provides opportunities for investors who benefit from financial diversification.

Today, three general categories of post-earthquake financial decision-making benefit from detailed NRT earthquake hazard input: (1) Rapid damage assessments that guide disaster response and aid deployment; (2) estimation of monetary loss to a portfolio of industrial, commercial, or residential exposures to guide the claims adjustment process; and (3) the triggering of so-called parametric transactions—insurance instruments that rely on the physical measurement of event characteristics to determine if the insured party receives compensation and how much. Here, we focus on these latter two categories.

Earthquake Insurance Strategies

As new financial instruments in earthquake risk mitigation have become available in the last several years, the U.S. Geological Survey (USGS) received more inquiries regarding the accuracy and usage of NRT tools. These inquiries prompted questions about how these financial instruments work and how they interact with NRT earthquake information, and call for an attempt to further link the scientific and business communities operating in this field. As a first step, we set out to provide a brief overview of existing insurance and alternative risk-transfer strategies that make use of NRT earthquake information systems.1

Earthquake insurance and related instruments play an important role in risk transfer. These mechanisms complement more direct forms of risk mitigation such as stricter building codes or improved infrastructure. Such policies may cover damages to the built environment, injury, casualty, and business interruption. Both private individuals and companies purchase insurance products to protect their assets. In doing so, they cede their risk to an insurance company, which acts as a risk aggregator that diversifies risk across the population. Insurance companies, in turn, may choose to cede risk to global reinsurance companies, thus providing further diversification. Naturally, the most well-known providers of insurance services are insurance companies. However, the availability of insurance-linked products arising from the capital markets has been growing in the past few decades (Artemis, 2016).

Insurance-linked securities (ILS) serve as a vehicle for investors unfamiliar with the insurance sector to market and deploy de facto insurance services. They attract institutional and private investors because they often have higher yields and provide diversification. Additionally, according to Artemis (2016): “Investors are looking to the ILS market as a new socially and societally responsible investment category, as an asset class that provides essential disaster risk capital after major impactful regional catastrophe or weather events, thus enabling a greater ability to recover from disasters.”

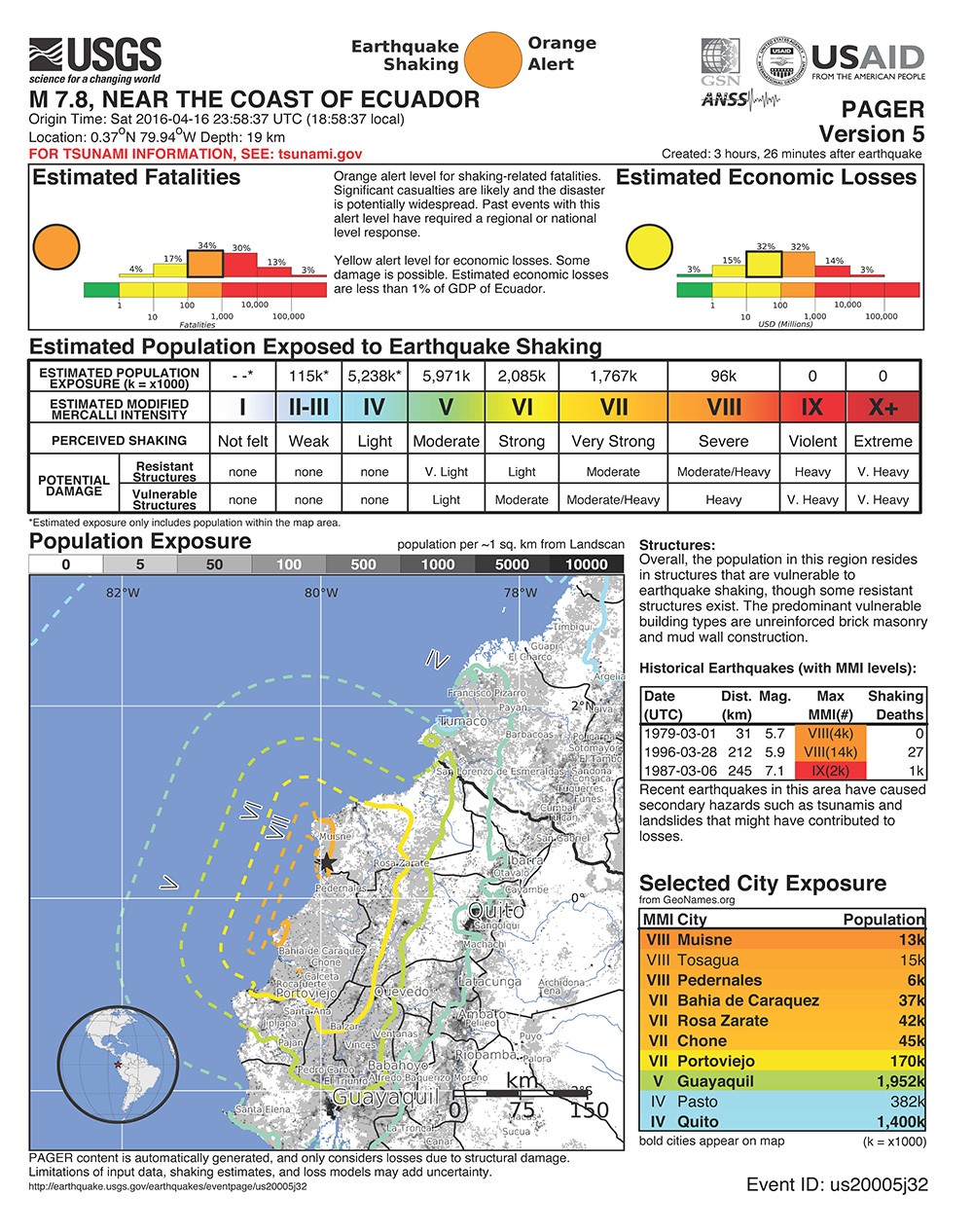

In this context, CAT bonds (a form of ILS) allow capital markets instead of governments to take on the risk of disaster financing in exchange for a premium (or spread in the investment lingo). These transactions can also provide capital in the immediate post-event environment (see the 2016 Ecuador earthquake for example, in Fig 1 and 2), not only to maintain cash-flow liquidity and pay claims but also to provide financial stability. The social benefits from such financial pre-planning can also include increased confidence and stability of markets in the immediate aftermath of a shaking-induced financial scare.

CAT bonds account for eight percent of the total global catastrophe reinsurance market (Acton, 2015). As of 2016, the outstanding CAT bond market is more than $26 billion. While indemnity insurance (which provides compensation based on actual loss) is the most common form of insurance in both the traditional and so-called “alternative risk transfer” market (the ILS market), non-indemnity-based strategies including CAT bonds make up a significant fraction. These non-indemnity solutions rely not on assessing actual losses, but on proxies to these losses. For example, rapidly determined magnitude and location parameters or the level of population exposed to areas of strong shaking can serve as a trigger for predefined payouts. As you could image, understanding the potential difference between the payout they generate and the actual losses—referred to as basis risk—plays an important role in setting expectations for the utility of these products.

These new financial strategies were possible largely because of the availability of more rapidly and accurately determined earthquake parameters and more quantitative geospatial hazard information. In addition to providing accurate estimates of magnitude and hypocentral parameters, the USGS earthquake information products now include ShakeMap (Worden and Wald, 2016) and the PAGER global loss modeling system (Wald et al., 2008). These benefit the financial sector because they provide estimates of shaking over the region affected, as well as early estimates of loss.

Types of Parametric Triggers

Non-indemnity mechanisms rely on a set of parameters to determine if an event triggers a payment. In the case of earthquake risk transactions, these are usually pre-agreed upon seismic hazard parameters determined by an independent reporting agency (typically the USGS). These parameters are strongly linked to NRT earthquake information systems both in their creation (trigger design) and in obtaining the actual parameters after an event. The immediacy of the parametric triggers and thus their allowance for a quick payout is one major advantage over indemnity-based instruments, which can take months or even years to pay out.

First-Generation (or “CAT-in-a-Box”) parametric tools appeared in the early 1990s. These instruments base payments on independently measurable parameters of the physical event—that is, the magnitude of the event and the location of its focus. Their mechanism is extremely simple and that is their main strength: If an earthquake occurs in a pre-determined geographic area and is of a magnitude greater than a set threshold (according to the reporting agency), the instrument generates an immediate payout. They are very simple to set up and for investors and sponsors to understand. Their rapid payout provides financial liquidity and reduces financial uncertainty. Their main limitation is their high-basis risk—the potential gap between payment and the actual losses, since the fundamental parameters of an earthquake might only loosely correlate to the losses that follow. This can be perceived as an advantage since it allows the sponsor (the party who issues the bond) to get financial coverage for losses that are hard to predict and quantify, such as business interruption, and demand surge.

Example 1: The recent $200 million Acorn Re 2015-1 CAT bond is a western United States parametric trigger-based earthquake bond that provides coverage for Kaiser-Permanente (Artemis, 2016) for three years. Parts of British Columbia, northern Mexico, and seven western states are in the coverage area, but most of the exposure is in California. The geographic area is divided into one-degree (~110 km2) boxes to distinguish events according to their location and magnitude; it has four severity levels triggering variable event-loss percentages. For example, for the Cascadia subduction zone, magnitudes of 8.2, 8.5, 8.7, and 8.9 trigger 25 percent, 50 percent, 75 percent, and 100 percent coverage, respectively.

Second-Generation Parametric triggers allay some of these high-basis risk concerns by considering hazard intensities distributed among a series of locations near exposed assets, rather than the overall characteristics of the event. Parameters frequently used for these transactions consist of recorded or inferred ground motions. Cases in which there is high uncertainty in the exposure distribution could favor first-generation approaches, where areas that have reliable seismometer networks and well-known exposure could benefit more from second-generation approaches (Franco, 2015).

Second-generation parametric CAT bonds typically use shaking values from ShakeMap, or from proximal observed ground motions to establish the value of the index after an event. Modeling losses with ShakeMap input for parametric triggers is now standard operating procedure.

Example 2: The Turkish Catastrophe Insurance Pool (TCIP) combines exposure into a CAT bond that provides three-year reinsurance coverage for Istanbul. The parametric trigger uses recorded peak ground motions from the Kandilli Observatory and Earthquake Research Institute (KOERI) at Bogazici University, the reporting agency. KOERI will provide shaking values for input into a pre-arranged earthquake model, based on strong-motion sensor observations in the Istanbul region. For an event to qualify, its shaking must be greater than 0.1g for at least 10 percent of the calculation locations (Artemis, 2016). As a contingency, if KOERI data are not available after an event, it will source alternative data from the USGS ShakeMap.

For earthquakes, other parametric index-based triggers can, for example, be based on the ratio of the population exposed to a predefined shaking intensity level compared to the total population of the country (Fig. 2). Such an arrangement would ensure financial coverage for any earthquake for which significant pre-agreed upon measures of shaking levels affect some fraction of the country’s population. The main benefit of such triggers is that—being direct proxies for shaking, and thus damage—they potentially provide a better correlation between parametric losses and actual losses than first-generation triggers that are based on magnitude and hypocenter alone.

Example 3: The Inter-American Development Bank (IDB) structures sovereign liquidity guarantees (e.g., contingency loans) for natural disasters in seven Latin American countries. A 72-hour turnaround for indexed coverage calculations allows rapid dissemination of funds without the need for ground-truth assessments. The indexed payout of up to $300 million per country avoids the moral hazard2 associated with reported losses, but the basis risk may be high: ShakeMap shaking estimates are uncertain, and population exposure per intensity level (Figure 2) may not adequately characterize actual losses. IDB Contingent Credit Facility Loan triggering (up to $300 million per country) is based on USGS ShakeMap and uses PAGER population exposure per intensity level published 72 hours after a significant event (J. Martinez, IDB, oral communication, 2015). Loans are initiated for an earthquake with an intensity MMI-VI or greater that affects at least two percent of the population within the coverage area (Figure 2). On April 20, 2016, IDB activated a US$300M credit line to support the Ecuadorian government with losses and emergency expenses (ReliefWeb, 2016).

Figure 1. In Manta, Ecuador, one of the worst affected cities, the entire neighbourhood of Tarqui was destroyed. Thousands of people lost everything. © European Union/ECHO/ H. Avril 2016

Although the parametric triggers described portray the strongest link to NRT information systems, there are other types of triggers that also leverage NRT data in less direct ways. Modeled-Loss triggers, for instance, are derived from calibrated catastrophe models. Payouts are based on modeled losses simulated using these models and NRT earthquake information. All inputs (e.g., earthquake parameters, shaking prediction equations, causative faults, and observed shaking constraints) are carefully vetted and agreed upon in advance, and then NRT information is used to identify the modeled event that most resembles the actual event (or, in some cases, a new synthetic event may be built within the model to represent the actual event). To model potential loss values and set coverage rates, exposure estimates are required. Like parametric triggers, modeled-loss triggers can be settled relatively quickly (in weeks) since the input parameters are rapidly available.

Fig. 2 – April 2016 magnitude 7.8 Ecuador earthquake “onePAGER” loss estimates. Population per intensity level can be used as a trigger for a second-generation CAT bond or as a contingency loan trigger.

Example 4. The California Earthquake Authority (CEA) uses ShakeMap for post-earthquake evaluation of liquidity (solvency) for insured losses to California residential proprieties as well as for situational awareness. CEA guidelines require industry-standard (proprietary) insured loss estimates to report to the governor within 7 days of any significant earthquake that affects California (B. Patton, oral comm., 2015). CEA also employs ShakeMap for post-earthquake situational awareness via GIS-layer GeoJSON feeds in the aftermath of earthquakes.

Summary

While it is difficult to quantify precisely (because not all transactions are public), billions of dollars of relief and recovery funds already rely on NRT earthquake parameters. Monetary resources available for response and recovery depend in part on these preexisting financial arrangements. A better understanding of the tools of the trade and specific needs of the financial sector could further advance NRT earthquake information systems, which in turn could enhance the development of creative financial instruments and result in additional beneficial risk management alternatives for at-risk communities.

Discussion and debate of the role of the financial component of earthquake resilience will continue within the community. Healthy insurance mechanisms for disaster financing, arising from the capital markets as well as from the traditional insurance markets—and linked to a strong provision of scientific information—can contribute critical resources for a more holistic community-wide risk-mitigation strategy.

References

Acton, C. (2015). ATC/USGS Seismic Hazard User-Needs Workshop, September 2015, Menlo Park, CA. Retrieved May 11, 2016, from https://www.atcouncil.org.

Artemis (2016). Catastrophe bonds, insurance linked securities, reinsurance capital & investment, risk transfer intelligence. Retrieved May 11, 2016, from http://www.artemis.com/.

Franco, G. (2015). Earthquake Mitigation Strategies Through Insurance. In Beer M, Kougioumtzoglou IA, Patelli E, Au IS-K (eds). Encyclopedia of Earthquake Engineering, Berlin, Heidelberg: Springer Berlin Heidelberg. 1–18. Retrieved November 10, 2015, from http://link.springer.com/10.1007/978-3-642-36197-5_401-1.

ReliefWeb (2016). IDB supports Ecuador with credit line of $300 million after the earthquake. Retrieved May 11, 2016, from http://reliefweb.int/report/ecuador/idb-supports-ecuador-credit-line-300-million-after-earthquake.

Wald, D.J., P.S. Earle, K. Porter, K. Jaiswal, and T.I. Allen (2008). Development of the U.S. Geological Survey’s Prompt Assessment of Global Earthquakes for Response (PAGER) System, Proc. 14th World Conf. Earth. Eng., Beijing.

Wald, D.J., and G. Franco (2016). Financial Decision-Making Based On Near–Real-Time Earthquake Information, Proc. 16th World Conf. Earth. Eng., Santiago.

Worden C.B., and Wald D.J. (2016). ShakeMap Manual. Retrieved May 10, 2016, from http://usgs.github.io/shakemap/.

-

This article is a synopsis of a longer article by Wald and Franco (2016) aimed at the earthquake engineering community. Franco (2015) provides a comprehensive background of insurance-related earthquake mitigation strategies. ↩

-

Moral hazard is the risk that one party might manipulate loss information to their benefit in an insurance transaction—a claimant might exaggerate a loss, and an insurer might downplay it. It is typically cited as an advantage that the moral hazard of parametric insurance mechanisms is low, since all loss information depends on measurements that are provided by an unbiased third party. ↩

David Wald is a seismologist with the USGS in Golden, and is on the Geophysics Faculty at the School of Mines. He earned his Ph.D. in Geophysics from Caltech in 1993. Wald is involved in research, development and operations of several real-time information systems at the USGS National Earthquake Information Center. He led development of and manages “ShakeMap” and “Did You Feel it?”, and is responsible for developing other systems for post-earthquake response and pre-earthquake mitigation, including “ShakeCast” and “PAGER”.

Wald has been the Seismological Society of America (SSA) Distinguished Lecturer and Associate Editor, and served on the Society’s Board of Directors. He currently serves on the Earthquake Engineering Research Institutes (EERI) Board of Directors and was EERI’s 2014 Distinguished Lecturer.

He was awarded SSA’s 2009 Frank Press Public Service Award, and a Department of the Interior Superior Service Award in 2010 and the Meritorious Service Award in 2016. Previously at Caltech, and now at the Colorado School of Mines, Wald has advised dozens of post-doctoral, graduate, and undergraduate student research projects. His own scientific interests include the characterization of rupture processes from complex recent and historic earthquakes; seismic waveform modeling and inversion; analysis of ground motion hazards and site effects; earthquake source physics; and modeling earthquake-induced landslides, liquefaction, and losses.