A First Step Towards Longitudinal Study on Homeowners’ Proactive Actions for Managing Wildfire Risks

Publication Date: 2021

Abstract

Wildfire has become an increasing threat to humans, built environment, and ecosystems in the United States. Such increases in wildfire risk are attributable to several factors, including the increased frequency, intensity and/or duration of wildfires induced by a changing climate and rapid population growth and infrastructure development at the wildland-urban interface. To reduce wildfire risk, the federal and local governments implement a variety of community-level wildfire protection plans. While community-level wildfire risk reduction efforts are effective in reducing the likelihood and consequences of wildfire, individual responsibility also plays an important role in reducing structure-level ignitability, and in turn, overall community vulnerability. If wildfire cannot be completely prevented or mitigated through both community- and individual-level risk reduction efforts, homeowners insurance can serve as the second line of defense by allowing homeowners to transfer risk and avoid substantial financial burden from repair/reconstruction costs induced by wildfire. By doing so, homeowners insurance reduces the delay of the housing recovery process due to lack of financing and expedites post-wildfire community recovery.

To understand homeowners’ decisions on wildfire-related proactive actions and their effects on housing recovery, this project conducted an online survey of homeowners in high to extreme risk of wildfire in the Western United States and collected data related to two types of proactive actions that homeowners can take prior to a wildfire event: individual-level risk reduction actions (i.e., home strengthening and defensible space) and homeowners insurance. First, regression models were estimated to identify key characteristics of homeowners and house/property affecting their intention to take proactive action. The results indicated that homeowner’s age and household income were the two common factors affecting their decisions about home strengthening and insurance policies. While the key independent variables in the regression models for such actions were related to the characteristics of homeowners and their houses, the only statistically significant factor in homeowners’ decisions about defensible space was satisfaction with the surrounding environment. It can be interpreted that homeowners perceived the design and maintenance of defensible space as an action to mitigate wildfire risks to the surrounding environment rather than a house itself. Moreover, we evaluated the effect of each proactive action on the housing recovery process. The findings showed limited support for the influence of individual-level wildfire risk reduction actions on reduced house damage. However, the findings clearly supported the relationship between risk reduction actions and housing recovery time. The survey results also indicated that homeowners with insurance initiated their housing recovery process quicker than homeowners who did not have insurance and were less likely to experience financial hardship following a wildfire event.

The online survey data collected as part of this project can serve as a first step towards the longitudinal collection of homeowners’ proactive actions and their effects on housing recovery. Since the study area has experienced a series of wildfires in the past few decades and is expected to experience wildfires in the future, the study region is suitable for longitudinal data collection to investigate how time-evolving homeowners’ characteristics may affect their proactive actions and community resilience in response to future wildfire events.

Introduction

Wildfire risk has increased significantly in recent years and is expected to grow across many parts of the United States. Eight of the top ten costliest wildfires in the United States occurred between 2017 and 2020 (Insurance Information Institute, 20201), with notable examples in California (e.g., the Carr Fire, the Woolsey Fire, and the Camp Fire, all of which occurred in 2018 and destroyed over 20,000 structures in California). Climate change may play a role in increasing the frequency and severity (in terms of fire size and duration) of wildfire. More importantly, however, growing population and human activities in the wildland-urban interface (WUI) have altered the environment and increased the exposure of human and high-value assets to wildfire, making the problem even more complicated and severe (Westerling et al., 20112; Moritz et al., 20143; Smith et al., 20164). One-third of residential buildings in the United States are located in the WUI (Wisch & Yin, 20195), and 4.5 million U.S. homes are at high to extreme risk of wildfire (Verisk, 20196). Such population growth in the WUI, where flammable vegetation is dominant, has increased the likelihood of wildfire ignition, considering that 90% of wildfires are human-caused. Moreover, increasing exposure in wildfire-prone areas has made small fires in the past (e.g., Awbrey Hall fire, Oregon, 1990) pose greater risks to current communities in the WUI, as demonstrated by Wisch and Yin (2019). With the increasing occurrence of large wildfires and their higher consequences, in recent years, the federal/local governments, insurance companies, and the general public have paid greater attention to risk mitigation actions to protect communities from potential wildfires.

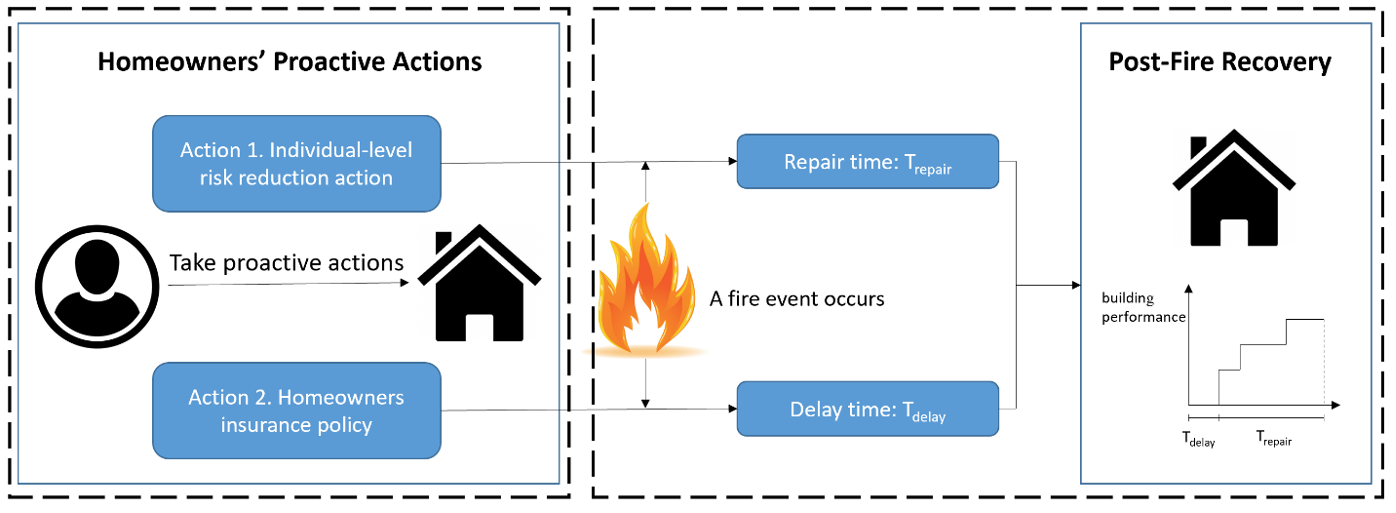

As part of wildfire risk reduction efforts, a variety of community-level wildfire protection plans has been proposed and implemented. These plans include zoning regulation; fire department support; adequate water supply and flow for firefighting; road improvement for facilitated access; and public education and outreach (Communities Committee, 20047). Most of these services are provided or regulated by local agencies to collectively improve community resilience prior to, during, and following a wildfire event. For example, the Community Wildfire Protection Plan has helped nearly 4,800 communities in the United States WUI in identifying their priorities for the protection of life, property, and critical infrastructure (Communities Committee, 2004). In addition to community-level collective actions, individual homeowners’ proactive actions are also vitally important for enhancing community resilience. As described in Figure 1, there are two types of proactive actions that homeowners can take prior to a wildfire event.

Proactive Action 1: Individual homeowners can adopt wildfire risk reduction actions, including the use of nonflammable or ignition-resistant materials; installation of dual pane windows or fire sprinklers; and design and maintenance of defensible space. These proactive actions are intended to reduce the likelihood of ignition and combustion of an individual house and remove potential ignition sources around the house, thereby reducing house and community vulnerability to wildfire.

Proactive Action 2: Individual homeowners can purchase homeowners insurance to reduce wildfire loss if wildfire cannot be completely prevented or mitigated through both community-level and individual-level risk reduction efforts. Homeowners insurance, which covers damages to structures and personal belongings induced by wildfire and smoke, is a viable option for homeowners to reduce excessive financial burdens from repair/reconstruction costs following a high-consequence wildfire event. With sufficient insurance coverage, homeowners may receive reliable and timely claim payments that enable the expedited recovery processes of houses, and in turn, the community as a whole.

Figure 1. Overall Structure of the Study.

Individual homeowners take different proactive actions based on their property type and value, financial availability, mortgage situation, risk perception and attitude, previous experience with wildfire and other natural hazards, etc. For example, based on the Protective Action Decision Model (PADM), people who have experienced disasters are more inclined toward taking risk mitigation actions. Although homeowners perceive wildfire risk to be high, they may not be willing to adopt risk mitigation actions because (a) the costs of such actions are high, and (b) the effectiveness of such actions is greatly affected by the actions taken by neighboring homeowners. These reasons may reduce the motivation of homeowners to adopt such actions and encourage the free-rider problem. Moreover, although homeowners insurance is required for all individuals who have a mortgage, many houses are underinsured or even uninsured (e.g., inherited houses, houses bought without a mortgage), delaying house and community recovery. As such, many homeowner- and property-related variables affect homeowners’ decisions about proactive actions, which needs to be well understood to support wildfire-resilient communities. The longitudinal collection of quantitative data is the key first step leading to understanding homeowners’ proactive actions and their role in communities exposed to wildfires.

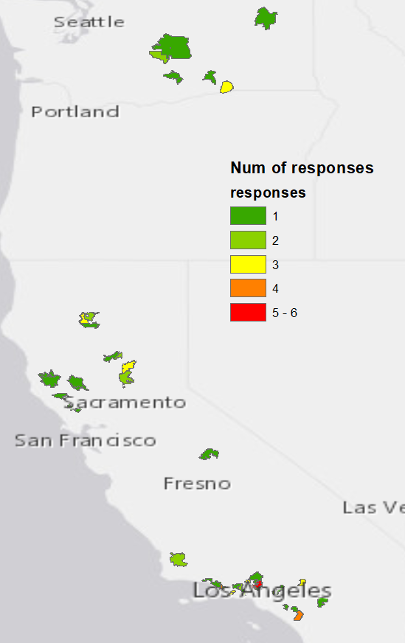

Figure 2. Study Area and the Number of Survey Responses Received From Each Zip Code.

The main goal of this project is to advance the understanding of (a) potential factors that may affect homeowners’ proactive actions for managing wildfire risks and (b) the role of such actions in housing recovery. To achieve the goal, the project team conducted a post-wildfire online survey of homeowners in multiple counties at high to extreme risk of wildfire in California and Washington as shown in Figure 2. These counties were selected due to data sufficiency: since homes in these areas have experienced a series of wildfires in the past few decades and are expected to be affected by wildfires in the future, the selected counties are suitable for the longitudinal data collection. Based on online survey results, we identified the key factors that contributed most to homeowners’ decisions about each proactive action and estimated a logistic regression model in order to relate the characteristics of houses and homeowners to their willingness to invest in the proactive action. Then, the effect of proactive actions on the housing recovery process was explicitly modeled by assessing (a) the effect of homeowners insurance policy on delay time (Tdelay) and (b) the effect of individual-level risk reduction actions on housing repair time (Trepair). This project will serve as a first step toward the longitudinal collection of homeowners’ proactive actions and their effects on housing recovery, which will be further used to investigate how time-evolving homeowners’ characteristics may affect their proactive actions and community resilience in response to future wildfire events.

Literature Review

Community-Level Wildfire Risk Reduction Efforts

Since the early 1900s, the U.S. federal and local governments have developed and implemented wildfire risk reduction policies. In the early stages, these policies were intended to reduce the consequences of wildfire by suppressing fires in an efficient and timely manner (Yin, 20188), which included fire department support, fire crew allocation, adequate water supply and flow for firefighting, and road improvement for facilitated access. Wildfire policies have since evolved, and community-level efforts have placed more emphasis on reducing the likelihood of wildfire by removing fuel accumulation in high-risk areas (Yin, 2018). For example, the Butte County Fire Prevention Program recently added multiple risk management activities such as pre-fire strategies and tactics, vegetation management (i.e., clearing fuels around communities and along roadways and evacuation routes), and fire break zones (Butte County, 20219). The federal and local governments also enforce compliance with defensible space laws and regulations and home strengthening to reduce property-level risk, which will be described in the next section in more detail. To increase wildfire awareness and educate homeowners about wildfire risk reduction actions and evacuation preparedness, educational workshops and brochures are also provided as part of community-level efforts.

Individual-Level Risk Reduction Actions

In response to wildfire incidents, individual responsibility plays an important role in reducing structural ignitability. It has been demonstrated that the potential for ignition of a structure can be significantly decreased by reducing its ignition vulnerability to firebrands and flames (i.e., home strengthening) and creating defensible spaces surrounding a house (Communities Committee, 2004; Syphard et al., 201410). Home strengthening involves the use of non-combustible or ignition-resistant siding and trim and the installation of Class A fire-resistant roof assembly, dual pane windows, and/or fire sprinklers, all of which decrease the likelihood of ignition and combustion of an individual house. Designing and maintaining defensible space creates the buffer between a house and surrounding vegetation to slow the spread of wildfire and protect the house from fire. For example, the U.S. National Fire Protection Association (NFPA) defines three home ignition zones based on the distance from the exterior point of a house (NFPA, 202111): immediate zone, intermediate zone, and extended zone, which are the areas of 0 – 5’, 5 – 30’, and 30’ – 100’ from the furthest attached exterior of the house, respectively. The NFPA suggests various risk reduction actions that should be taken for each zone ranging from removing flammable material to vegetation treatment (e.g., thinning tree canopies, spacing trees). The abovementioned individual-level risk reduction actions not only protect a house from wildfire but also affect the vulnerability of neighboring houses. Evans et al. (201512) found that such individual-level efforts can reduce the average home hazard by 20%.

The extent of structural damage induced by wildfire depends on various factors that include property-level parameters and landscape factors such as vegetation management, fuel characteristics, and topography. To gain knowledge about the relationship between wildfire risk mitigation actions and the associated structural damages, several studies (Moore, 198113; Radtke, 198314; Syphard et al., 201215; Penman et al. 201416; Alexandre et al. 201617; Syphard et al., 201718) have recently investigated the effects of individual-level risk reduction actions on building damage and its survival rate. As most of them have utilized computer-based simulation or laboratory experiments, until recently, existing wildfire risk mitigation actions have been driven from limited empirical studies that are based on significant assumptions on fire behavior, thus resulting in highly theoretical “best practices” (Syphard & Keeley, 2019[^Syphard & Keeley, 2019]). Without having the actual damage and response dataset, it is nearly impossible to predict the best proactive plan. Hence, post-wildfire surveys and field studies are necessary to collect observations and validate simulation and/or laboratory results. While a number of researchers have attempted to conduct post-wildfire field surveys on schools and hospitals (Schulze et al., 202019), channel environment (Benda et al., 200320), etc., few studies have collected post-wildfire structural damage sustained by houses. This project was originally designed to collect the extent of damage of individual houses with different levels of risk reduction efforts through a post-wildfire field survey to fill this research gap. However, due to COVID-19, the project team changed the research plan and assessed the effect of risk reduction actions on house damage through an online survey.

Homeowners Insurance

Insurance is another important proactive action that homeowners can take to reduce monetary losses resulting from residual wildfire risks (Zhao et al., 202021). The role of catastrophe risk insurance has been well investigated in several studies (Hazell, 200122; Kunreuther & Pauly, 200623). Most of these studies to date, however, have focused on catastrophe insurance (e.g., earthquake insurance, flood insurance)—which is not covered by homeowners insurance and requires a separate endorsement—and have evaluated the role of government in increasing homeowners’ willingness to buy insurance. Moreover, existing studies have assessed the effects of catastrophe insurance on community resilience qualitatively rather than quantitatively. Partly due to the lack of quantitative assessment, the role of insurance has often been underestimated or neglected in many community resilience planning studies. While a limited number of studies have investigated forestland owners’ or homeowners’ behavior in insurance purchase through experimental economics and survey (McKee et al., 200424; Gan et al., 201425), most of these studies have considered only binary variables in their model (i.e., purchase insurance or not). Given that homeowners insurance is required for all individuals with a mortgage (i.e., over 70% of the U.S. population), homeowners insurance coverage limits play a more important role in housing recovery than insured status does. Moreover, these studies have not related homeowners’ purchasing behavior to their financial availability following a hazard event. This study addressed this significant gap in knowledge about homeowners’ behavior in insurance policy selection and investigated the role of insurance in the housing recovery process by conducting an online survey of homeowners in California and Washington.

Methods

Data Collection

This study used a quantitative approach to identifying independent variables that are likely to influence homeowners’ proactive actions for managing wildfire risks and assessing their impacts on housing recovery processes. To collect data used to support quantitative models, the team originally planned to conduct an online survey of homeowners in Sonoma County, California, who experienced the 2019 Kincade Fire. After conducting a soft launch, however, the team broadened the study area by including additional counties in California (90 zip codes) and Washington (17 zip codes) that experienced wildfires in the past five years (see Figure 2). The zip codes were identified by being overlaid with the layer containing shapes of wildfires in the past five years in ArcMap. This change to the study area increased the feasibility of collecting sufficient data while allowing the team to achieve the study’s originally planned aim and scope.

Data were collected through an online survey with participants recruited by Qualtrics research service, a professional organization that uses prequalified respondents to achieve significant response rates for the purpose of validity. The survey participants were selected via cluster sampling. The inclusion criteria for participating in this survey were to be homeowners in the study area who were at least 18 years of age and whose houses were damaged by at least one wildfire event (i.e., house experienced at least a minor damage state due to wildfire) in the past five years. To enable participants to clearly understand the four damage states (i.e., none, minor damage, major damage, and destroyed) sustained by a house due to wildfire, a detailed information page describing the damage states was provided at the beginning of the survey. The page presented the images of a house experiencing each damage state along with the description of each damage state as illustrated in Table 1. Moreover, participants were required to have their homeowners insurance policy document (the policy they held at the time when the most recent wildfire attacked their properties) at hand so that they could answer the questions related to their insurance policies.

The online survey consisted of a set of closed-ended quantitative and qualitative questionnaires, including demographic information; property type and value; risk perception/attitude; previous experience with wildfire and other natural hazards; homeowners insurance policy; homeowner financial availability, mortgage situation, and proactive actions taken at the time of the most recent wildfire event; and time to initiate and complete the recovery of their houses. After excluding all invalid responses, we collected 80 valid responses, which was fewer than we expected. Due to the screening question that required participants to experience at least minor damage to their houses due to wildfire in the past five years, the target population size was reduced significantly even after broadening the study area. Given that less than 20,000 houses were damaged or destroyed by the top five costliest wildfires in U.S. history, it is expected that the target population was small.

Sample

The demographic characteristics of the sample are presented in Table 2. Sixty percent of the participants were male, and forty percent of the respondents were female. The age group between 30 and 39 years old comprised the highest proportion in the sample, and 68.75% of the respondents were Caucasian. The majority of the respondents (86.25%) attended college. At the time when the most recent wildfire attacked their properties, 72.5% of the respondents were employed, and 17.5% of the respondents reported an annual household income before taxes of less than $24,999, followed by $50,000 to $74,999 (16.25%) and $75,000 to $99,999 (16.25%).

Data Analyses and Preliminary Findings

The data were analyzed in two steps. First, we assessed the effects of independent variables on homeowners’ decisions about two different types of proactive actions and identified the key variables that should be included in the logistic regression models. Then, we constructed the quantitative relationship between homeowners’ proactive actions and the delay and repair times of a damaged house to examine the most effective action in expediting the housing recovery process.

Regression Models for Two Types of Proactive Actions

First, we identified key variables affecting each type of proactive action (i.e., individual-level risk reduction actions and homeowners insurance) and estimated the logistic regression model for each action based on the survey data. The independent variables considered at the initial step of estimating the regression models were the variables that describe the characteristics of house/property and homeowners and are summarized in Tables 2 and 3. We first coded all these independent variables as dummy variables to analyze qualitative data such as categorical representation (e.g., house damage state, demographic information). A homeowner can decide whether or not to take a certain type of proactive action before a wildfire event, and, accordingly, a decision variable takes two values, 1 (take action) or 0 (do not take action), which are mutually exclusive and collectively exhaustive. Thus, the probability (p) that an individual homeowner takes a certain type of proactive action is expressed by the following logistic regression equation: p=e^βX/(1+e^βX ) (1)

in which β = the vector of coefficients for independent variables and X = the vector of independent variables. Higher p indicates a higher probability that a homeowner takes the proactive action. The regression model for each proactive action was estimated using a backward stepwise regression approach. It began with all the independent variables and at each step gradually eliminated variables from the regression model to find a model that best represents the data. At each step, the Wald Chi-Square Test was used to select the variable that should be eliminated: the variable with a p-value greater than a 5% level of significance was eliminated. This process was repeated until all the remaining variables did not meet the specified level for elimination.

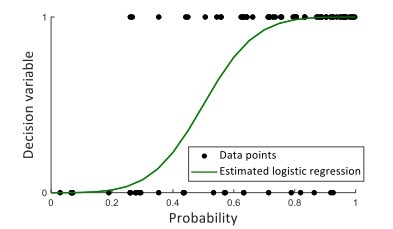

Figure 3. Comparison of Homeowners’ Decisions about Home Strengthening Between Simulated and Survey Results.

Individual-Level Risk Reduction Actions

Logistic regression models were estimated for two types of individual-level risk reduction actions (i.e., home strengthening and defensible space), respectively. The survey asked participants to indicate the types of individual-level risk reduction action they took at the time when the most recent wildfire attacked their properties and then classified them into two categories: home strengthening (e.g., use of non-combustible or ignition-resistant siding and trim, installation of Class A fire-resistant roof assembly, installation of multi-pane windows or ideally tempered glass, installation of fire sprinklers) and defensible space (e.g., design and maintenance of the immediate, intermediate and/or extended zones). Hence, the dependent variables for the regression models were whether or not home strengthening or defensible space was adopted at the time of the most recent wildfire. Based on the survey results, 65% of the respondents adopted home strengthening, while 58.75% of the respondents adopted defensible space. As shown in Table 4, the key independent variables that affected decisions to adopt home strengthening were homeowner’s age, household income, total wealth, and willingness to invest in individual-level wildfire risk mitigation actions. Homeowners’ decisions about home strengthening obtained from the survey were plotted against the simulated ones from the regression model in Figure 3. It showed 80% accuracy in estimating decision variables. The logistic regression results for defensible space are summarized in Table 5. Satisfaction with the surrounding environment was identified as the only variable that significantly affects homeowners’ decisions to design and maintain defensible space surrounding their homes. Seventy percent of the simulated results from the regression model for defensible space matched the survey results. As presented in Table 5, the variables describing the characteristics of homeowners and houses did not have any statistically significant impacts on homeowners’ decisions about defensible space. It can be interpreted that homeowners perceived defensible space as a proactive action to mitigate wildfire risks to the surrounding environment rather than a house itself, whereas home strengthening was adopted to protect their houses from wildfires.

Homeowners Insurance

A logistic regression model for homeowners insurance was also estimated using backward stepwise regression approach. All the independent variables listed in Tables 2 and 3 were initially considered in the logistic regression and eliminated sequentially until all the variables that met the specified level for elimination were removed. The dependent variable was binary: a homeowner purchased or did not purchase homeowners insurance at the time when his/her property was affected by the most recent wildfire. The survey data indicated that 80% of respondents had homeowners insurance in place at the time of wildfire. As presented in Table 6, the homeowner’s mortgage balance and neighbors’ proactive actions were identified to have statistically significant impacts on homeowners’ decisions about insurance purchase. Considering that homeowners with a mortgage were required to purchase homeowners insurance, the finding that positive mortgage balance was the most significant factor in this regression model was well-supported.

As explained in the Literature Review section, a binary logistic regression model for insurance purchase could be meaningful if homeowners can fully decide whether to buy insurance based on their preference. However, about 70% of U.S. households have a mortgage, and lenders require homeowners with a mortgage to insure houses to protect their investment. Consequently, these homeowners do not have much room to decide whether or not to purchase homeowners insurance. However, they may have more freedom to choose insurance coverage (although some lenders still have minimum requirements for dwelling coverage). Moreover, insurance coverage plays a critical role in estimating the financial availability of homeowners following a wildfire event. If a house is not fully insured, homeowners still experience financial hardship and tend to delay house recovery until they obtain financing. In light of this, in addition to the binary logistic regression model for insurance purchase, we also examined the independent variables that might affect homeowners’ decisions about insurance policy and estimated a regression model.

Homeowners insurance policy includes four types of coverage: dwelling, personal property, additional living expenses (ALE), and liability protection. The survey did not include any questions pertinent to liability protection because the study focused on structural damage to the house, attached structure, and personal property and the associated economic losses. Dwelling coverage is the main component of homeowners insurance policy, and the other two coverages are often determined by the percentages of the selected dwelling coverage, such as 50% to 70% of dwelling coverage for personal property and 20% of dwelling coverage for ALE. Thus, a linear regression model for dwelling coverage limit was estimated. The ordinary least squares approach was used to estimate unknown coefficients, and then a stepwise backward approach with t-tests was used to eliminate insignificant independent variables. The results are summarized in Table 7. As expected, property value had the greatest impact on homeowners’ decisions about dwelling coverage limits. Interestingly, the other two independent variables (i.e., age and household income) in the regression model were also the key variables that are likely to affect homeowners’ decisions to adopt home strengthening. Given that the binary regression model for insurance purchase does not reflect homeowner’s preference appropriately, homeowner’s age and household income can be considered the two most statistically significant factors affecting homeowners’ decisions to take proactive actions.

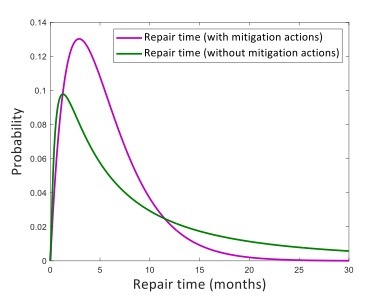

Figure 4. Effect of Individual-Level Risk Reduction Actions on House Repair Time.

After estimating a set of regression models for individual-level wildfire risk reduction actions and homeowners insurance, we quantitatively assessed the effect of these proactive actions on house damage state, delay time and repair time of a damaged house, and homeowner’s financial availability following a wildfire event. These quantitative models developed based on the survey data will help identify the most effective proactive action in expediting housing recovery and can be used in simulations to estimate housing/community recovery following a wildfire scenario event.

First, we assessed the effect of individual-level wildfire risk reduction actions on house damage state. Only 12.5% of the respondents did not take any pre-wildfire risk reduction actions (i.e., either home strengthening or defensible space) at the time when their houses were affected by the most recent wildfire. As shown in Table 8, 60% of homeowners without any risk reduction actions experienced minor structural damage to their houses, while 40% of their houses were destroyed by a fire. The vast majority (87.5%) of respondents adopted at least one individual-level wildfire risk reduction action, and minor structural damage comprised the highest proportion (64%), followed by destroyed (22%) and major damage (14%). Based on the results, it was not clear if risk reduction actions were effective in reducing wildfire damage to a house, even though it is intuitively true. This is because most homeowners who benefitted from risk reduction actions (i.e., homeowners who adopted risk reduction strategies did not experience any structural damage to their homes during a wildfire) were screened out of the survey.

We also examined the effect of individual-level wildfire risk reduction actions on house repair time. Figure 4 shows the comparison between the repair times of a house with and without at least one mitigation measure. The mean repair times of a house with and without risk reduction actions were 5.67 months and 13 months, respectively, and the repair time of a mitigated house had a lower standard deviation and lighter upper tail. Although the effect of risk reduction action on structural damage to a house was not clear, its effect on house repair time was significant. This inconsistency might arise because (a) a higher portion of un-mitigated houses was completely destroyed (see Table 8), which induced much longer repair time; and (b) respondents did not self-assess their house damage states appropriately only based on visual and written description (see Table 1) due to its subjective nature, while repair time was expressed in quantitative terms and easy to measure.

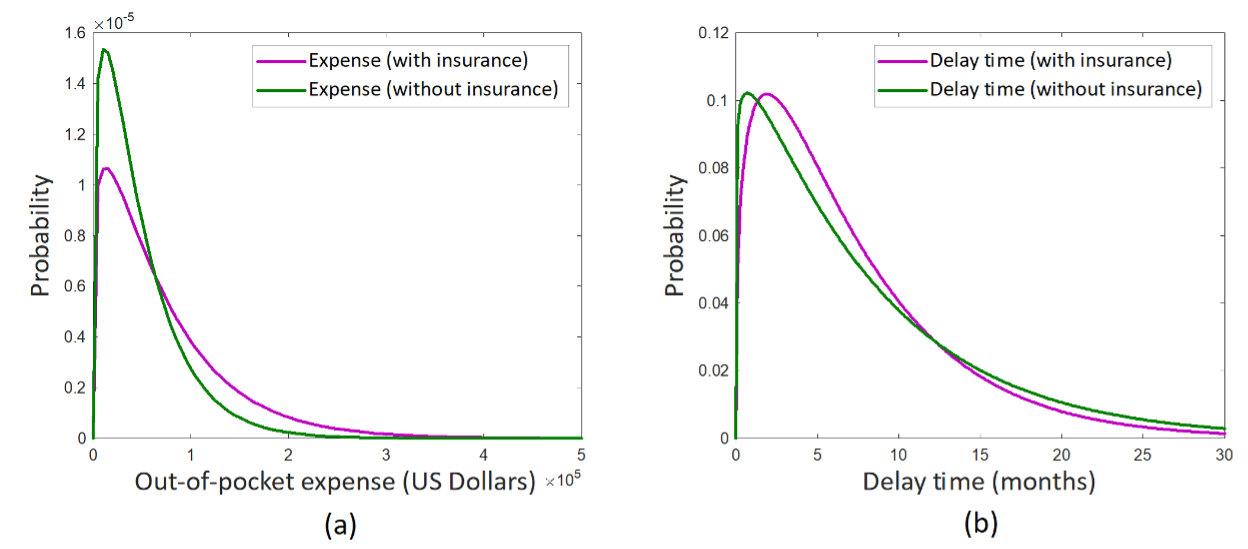

We also assessed the effect of homeowners insurance on the financial availability of homeowners following a wildfire event because their post-wildfire financial situation determines the financing delay time of the housing recovery process as well as the socioeconomic resilience of the community. Several questions about homeowner’s financial situation before and after wildfire were included in the survey. For example, we estimated homeowners’ out-of-pocket expenses due to house repair/reconstruction by measuring homeowners’ estimated total wealth (including housing equity, vehicles, retirement, life insurance, fixed income investment, managed assets, common stock and mutual fund shares, liquid assets, farms, business equity in other real estates, and net worth) prior to and following a wildfire event. Participants were also asked to answer questions about total combined economic losses resulting from the most recent wildfire that affected their properties (including repair/reconstruction cost, personal belonging damage, and additional living expenses) and the type of financial hardship they experienced due to wildfire damage (e.g., mortgage default, mortgage forbearance, selling their properties, huge loan or debt, etc.). The participants were divided into two groups (Group A: homeowners with insurance and Group B: homeowners without insurance), and the out-of-pocket expenses (due to wildfire damage) of the two groups were compared. Gamma distribution provided the best fit to the out-of-pocket expenses of both groups, as shown in Figure 5(a). Contrary to our expectation, this comparison did not indicate that homeowners insurance reduced the financial burden of the Group A homeowners following a wildfire event; the mean values of out-of-pocket expenses were $72,266 (Group A) and $48,438 (Group B). However, 50% of Group A homeowners still indicated that insurance was the most helpful financial source for them to recover from the wildfire attack, followed by loans (23.43%), government assistance (18.75%), and other sources (7.82%). We also found that 35.9% of Group A homeowners responded that they did not experience any financial hardship after experiencing wildfire, while only 25% of Group B homeowners did not experience any financial hardship. Moreover, Group A homeowners answered that, on average, 75.38% of repair/reconstruction costs were covered by insurance. The latter three results showed that homeowners insurance was effective in reducing homeowners’ financial burden, which was contrary to the result shown in Figure 5(a). It may be because (a) 21.9% of the homeowners who had insurance did not file a claim and did not get any compensation from insurance companies; and (b) total economic losses that Group A experienced following a wildfire event ($187,500) was 27.7% greater than the one that Group B experienced ($146,875), and consequently, out-of-pocket expenses of Group A were greater than the ones of Group B.

Moreover, the effect of homeowners insurance on delay time (Tdelay) was examined. Delay time is defined as the time between wildfire containment and the initiation of the house repair/reconstruction process and can be induced by many different impeding factors, such as post-disaster inspection; engineering mobilization and review/redesign; financing; contractor mobilization and bid process; and permitting. (Zhao et al., 2020). The survey question asked participants about the time taken to initiate their structural (house) repair/reconstruction process since the wildfire in the community had been contained. Figure 5(b) shows the fitted probability distributions of delay times of Groups A and B, respectively. The mean value of delay time of Group A (7.24 months) was slightly less than the mean value of Group B (8.18 months). Since delay time was not only induced by lack of financing but also induced by other factors, homeowners insurance only slightly expedited housing recovery process by relieving excessive financial burdens for homeowners and providing an expedited insurance claim payment process (as compared to other financial sources). In conclusion, the findings indicated that individual-level risk reduction action was more effective in reducing total housing recovery time.

Figure 5. The Effect of Homeowners Insurance on (A) Out-Of-Pocket Expenses due to Wildfire Damage and (B) Delay Time.

Summary and Conclsuions

This project conducted a post-wildfire online survey of homeowners in multiple counties at high to extreme risk of wildfire in California and Washington to understand homeowners’ decisions on wildfire-related proactive actions and their effect on housing recovery. The online survey was targeted at homeowners in these counties whose properties were damaged by wildfires in the past five years. First, in order to identify the independent variables that are likely to influence homeowners’ decisions about the two types of proactive actions (i.e., individual-level risk reduction actions and homeowners insurance), the binary logistic regression model for each type of proactive action was estimated. The survey results revealed that homeowner’s age, household income, total wealth, and willingness to invest in individual-level wildfire risk mitigation actions were the key independent variables affecting homeowner’s decision about home strengthening, while the only key independent variable in the regression model for defensible space was satisfaction with the surrounding environment. In other words, homeowners tend to design and maintain defensible space to protect the surrounding environment from wildfire rather than a house itself. The binary logistic regression model for homeowners insurance purchase was also estimated in this study, and homeowner’s mortgage balance and neighbors’ proactive actions were identified as the two statistically significant independent variables in the model. This finding that a positive mortgage balance was the most significant factor in homeowners’ decisions about insurance purchase was well-supported by the fact that mortgage lenders require homeowners to have homeowners insurance in place. It can be inferred, however, that homeowners did not have much room to decide whether or not to purchase homeowners insurance because of this requirement. In this context, the study also estimated the regression model for homeowners’ decisions about insurance policy (i.e., dwelling coverage in this study). As expected, property value had the greatest impact on homeowners’ decisions about dwelling coverage limit, because in many cases, dwelling coverage limit is proportional to property value. Age and household income were identified as the other two key independent variables in the model. Given that the effect of these two variables on homeowners’ decisions about home strengthening was also significant, it was reasonable to conclude that homeowner’s age and household income were the important characteristics of homeowners affecting their intention to take proactive actions.

This project also collected quantitative data used in developing the relationship between homeowners’ proactive actions and the recovery processes of houses as well as homeowners’ post-wildfire financial situations. While the effectiveness of individual-level wildfire risk reduction actions in reducing house damage was not clear based on the survey results, their effect on house repair time was significant. Moreover, we also examined the effect of homeowners insurance on homeowners’ post-wildfire financial availability, but the results were contradictory: the answers to the three qualitative survey questions showed that insurance was an effective tool to lower homeowners’ financial burden needed for house repair/reconstruction following a wildfire event, whereas the answers to the quantitative survey question (out-of-pocket expense) showed results that contradicted our common belief. The findings also supported that homeowners insurance reduced the delay time of housing recovery slightly partly due to its expedited claim payment process. In conclusion, the two types of proactive actions were effective in expediting the housing recovery process following a wildfire event, while their effects on structural damage to houses and homeowners’ financial availability were not obvious in the survey results.

This study provided valuable insight into homeowners’ decisions about wildfire proactive actions and their effects on housing recovery. However, post-wildfire reconnaissance surveys should also be conducted to quantify the effects of individual-level risk reduction actions on structural damage to houses, and in turn, the repair time of houses. These results will complement the results obtained from the online survey because the impact of individual-level risk reduction actions on house damage was not clearly quantified in this study. Moreover, based on our content validity, some respondents seemed to have difficulty quantifying their total wealth, property values, expenditures, economic losses, etc. Thus, in-depth individual interviews with homeowners will also be helpful to provide sufficient information and guidance on such quantification processes to interviewees. The survey results from this project will serve as a first step towards the longitudinal collection of homeowners’ proactive actions and their effects on housing recovery. In the future, we will perform similar surveys of homeowners in the same counties considered in this study to investigate how time-evolving homeowners’ characteristics may affect their proactive actions and community resilience in response to future wildfire events.

References

-

Insurance Information Institute (III). (2020). Fact + statistics: Wildfires. https://www.iii.org/fact-statistic/facts-statistics-wildfires ↩

-

Westerling, A. L., Bryant, B. P., Preisler, H. K., Holmes, T. P., Hidalgo, H. G., Das, T., & Shrestha, S. R. (2011). Climate change and growth scenarios for California wildfire. Climatic Change, 109(S1), 445–463. https://doi.org/10.1007/s10584-011-0329-9 ↩

-

Moritz, M. A., Batllori, E., Bradstock, R. A., Gill, A. M., Handmer, J., Hessburg, P. F., Leonard, J., McCaffrey, S., Odion, D. C., Schoennagel, T., & Syphard, A. D. (2014). Learning to coexist with wildfire. Nature, 515(7525), 58–66. https://doi.org/10.1038/nature13946 ↩

-

Smith, A. M. S., Kolden, C. A., Paveglio, T. B., Cochrane, M. A., Bowman, D. M., Moritz, M. A., Kliskey, A. D., Alessa, L., Hudak, A. T., Hoffman, C. M., Lutz, J. A., Queen, L. P., Goetz, S. J., Higuera, P. E., Boschetti, L., Flannigan, M., Yedinak, K. M., Watts, A. C., Strand, E. K., … Abatzoglou, J. T. (2016). The science of firescapes: Achieving fire-resilient communities. BioScience, 66(2), 130–146. https://doi.org/10.1093/biosci/biv182 ↩

-

Wisch, R., & Yin, Y-J. (2019). Why are wildfires more destructive today? AIR Worldwide. https://www.air-worldwide.com/Blog/Why-Are-Wildfires-More-Destructive-Today-/ ↩

-

Verisk. (2019). Wildfire risk analysis. https://www.verisk.com/insurance/campaigns/location-fireline-state-risk-report/ ↩

-

Communities Committee. (2004). Preparing a community wildfire protection plan: A handbook for wildland urban interface communities. ↩

-

Yin, Y-J. (2018). Are wildfire policies and preparedness helping or hurting risk? AIR Worldwide. https://www.air-worldwide.com/blog/posts/2018/5/are-wildfire-policies-and-preparedness-helping-or-hurting-risk/ ↩

-

Butte County. (2021). *Fire Prevention https://www.buttecounty.net/fire/Firefacilities/Prevention ↩

-

Syphard, A. D., Brennan, T. J., & Keeley, J. E. (2014). The role of defensible space for residential structure protection during wildfires. International Journal of Wildland Fire, 23(8), 1165-1175. ↩

-

National Fire Protection Association (NFPA). (2021, April 13). Preparing homes for wildfire. NFPA. https://www.nfpa.org/Public-Education/Fire-causes-and-risks/Wildfire/Preparing-homes-for-wildfire ↩

-

Evans, A., Auerbach, S., Miller, L. W., Wood, R., Nystrom, K., Loevner, J., Aragon, A., Piccarello, M., & Krasilovsky, E. (2015). Evaluating the effectiveness of mitigation activities in the wildland-urban interface. Forest Stewards Guild. https://foreststewardsguild.org/wp-content/uploads/2019/05/WUI_effectivenessweb.pdf ↩

-

Moore, H. E. (1981). Protecting residences from wildfires: A guide for homeowners, lawmakers, and planners (Vol. 50). US Department of Agriculture, Forest Service, Pacific Southwest Forest and Range Experiment Station. ↩

-

Radtke, K. W. (1983). Living more safely in the chaparral-urban interface. U.S. Dept. of Agriculture, Forest Service, Pacific Southwest Forest and Range Experiment Station. ↩

-

Syphard, A. D., Keeley, J. E., Massada, A. B., Brennan, T. J., & Radeloff, V. C. (2012). Housing arrangement and location determine the likelihood of housing loss due to wildfire. PloS one, 7(3), e33954. ↩

-

Penman, T. D., Collins, L., Syphard, A. D., Keeley, J. E., & Bradstock, R. A. (2014). Influence of fuels, weather and the built environment on the exposure of property to wildfire. PLoS One, 9(10), e111414. ↩

-

Alexandre, P. M., Stewart, S. I., Mockrin, M. H., Keuler, N. S., Syphard, A. D., Bar-Massada, A., Clayton, M. K., & Radeloff, V. C. (2016). The relative impacts of vegetation, topography and spatial arrangement on building loss to wildfires in case studies of California and Colorado. Landscape Ecology, 31(2), 415-430. ↩

-

Syphard, A. D., Brennan, T. J., & Keeley, J. E. (2017). The importance of building construction materials relative to other factors affecting structure survival during wildfire. International Journal of Disaster Risk Reduction, 21, 140-147. ↩

-

Schulze, S. S., Fischer, E. C., Hamideh, S., & Mahmoud, H. (2020). Wildfire impacts on schools and hospitals following the 2018 California Camp Fire. Natural Hazards, 104(1), 901-925. ↩

-

Benda, L., Miller, D., Bigelow, P., & Andras, K. (2003). Effects of post-wildfire erosion on channel environments, Boise River, Idaho. Forest Ecology and Management, 178(1-2), 105-119. ↩

-

Zhao, J., Lee, J. Y., Li, Y., & Yin, Y. J. (2020). Effect of catastrophe insurance on disaster-impacted community: Quantitative framework and case studies. International Journal of Disaster Risk Reduction, 101387. ↩

-

Hazell, P. (2001). Potential role for insurance in managing catastrophic risk in developing countries. International Food Policy Research Institute, draft. ↩

-

Kunreuther, H., & Pauly, M. (2006). Rules rather than discretion: Lessons from Hurricane Katrina. Journal of Risk and Uncertainty, 33(1-2), 101-116. ↩

-

McKee, M., Berrens, R. P., Jones, M., Helton, R., & Talberth, J. (2004). Using experimental economics to examine wildfire insurance and averting decisions in the wildland–urban interface. Society and Natural Resources, 17(6), 491-507. ↩

-

Gan, J., Jarrett, A., & Gaither, C. J. (2014). Wildfire risk adaptation: Propensity of forestland owners to purchase wildfire insurance in the southern United States. Canadian Journal of Forest Research, 44(11), 1376-1382. ↩

Lee, J. Y., & Li, Y. (2021). A First Step Towards Longitudinal Study on Homeowners’ Proactive Actions for Managing Wildfire Risks (Natural Hazards Center Quick Response Research Report Series, Report 328). Natural Hazards Center, University of Colorado Boulder. https://hazards.colorado.edu/quick-response-report/a-first-step-towards-longitudinal-study-on-homeowners-proactive-actions-for-managing-wildfire-risks